Greater participation in capital markets is vital to engendering trust in financial services, according to BNY Mellon CEO Robin Vince. Speaking at a panel session at the World Economic Forum (WEF) meeting in Davos, Switzerland on how finance can benefit people, Vince spoke on the influence of innovation and the health of markets as critical components to achieving greater participation in capital markets. However, he believes participation in markets is the most important thing. This isn’t about how people access markets – be it active or passive – he said, but rather the importance of just being there.

Does finance benefit people?

How can the financial and monetary systems function more effectively to better serve society as a whole?

Vince pointed out to the Davos audience that after an internal BNY Mellon survey highlighted lack of market participation across its global staff, the company chose to make eligible employees shareholders in the firm. Granting staff BNY Mellon stock had a dual effect, Vince explained. One was to create a greater sense of ownership and interest, but it also provided the opportunity for market participation and investing. “It is important people save for the future but being a market participant can also build trust,” he said. “People are less willing to criticise an industry when they are a part of it.”

The panel, which consisted of academics, economists, central bank representation and a large U.S. pension investor, agreed greater access as well as understanding of how the markets work has large benefits. Some of these benefits are circular as Vince pointed out.

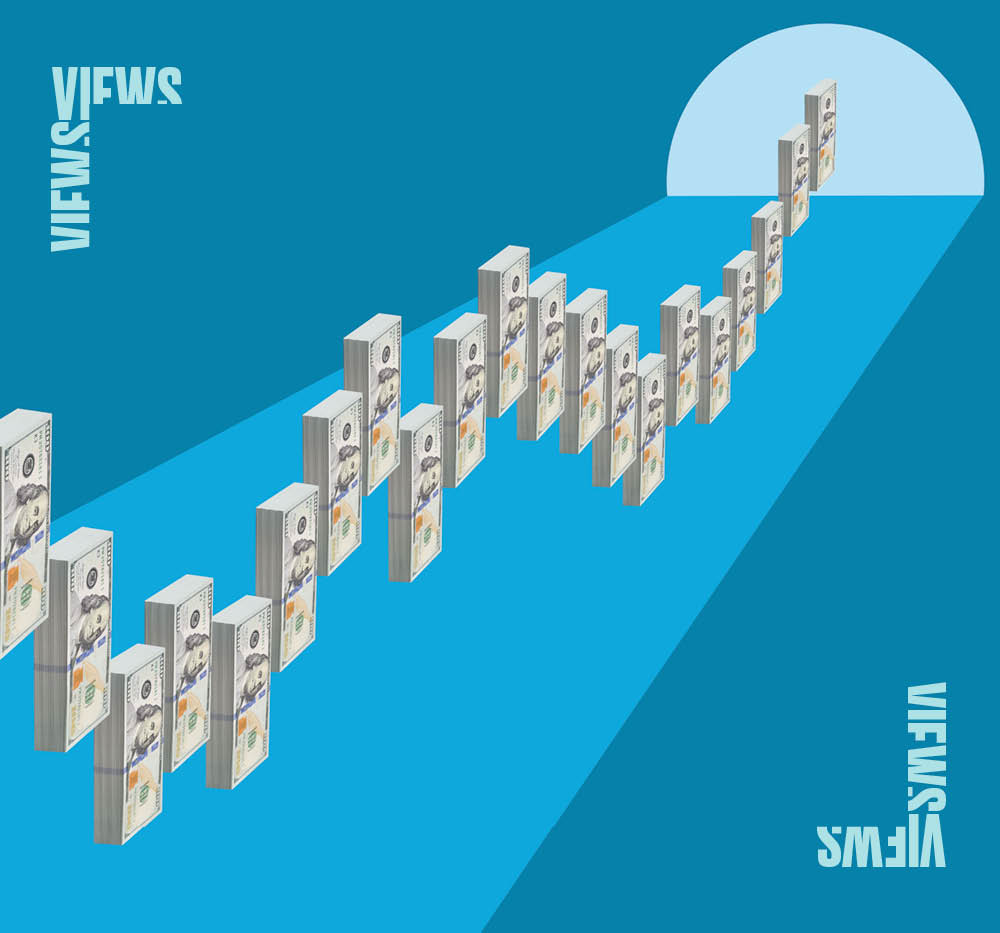

He commented: “Vibrant, healthy capital markets support economies and economic growth. It isn’t just down to the institutions - investors, lenders, the public and private markets must all come together, work together to build robust markets.”

Vince added that too often people have the perception that finance is only for the wealthy or too much attention is being paid to the innovative or new products that the industry creates. “We need to remember public equity and bond markets are still the largest,” he says. The largest investors in the world are also those that are investing on behalf of everyday people – for retirement. “We sometimes lose sight of that because we gravitate towards the new and the innovative,” he adds.

Vibrant, healthy capital markets support economies and economic growth. It isn’t just down to the institutions - investors, lenders, the public and private markets must all come together, work together to build robust markets.

Robin Vince, President and CEO, BNY Mellon

Greater financial education and understanding is needed to promote increased market participation, which in turn can improve its benefits not only for individuals but the health of economies, panel participants noted. “Many people don’t really understand the power of compounding,” one panelist pointed out, noting this knowledge gap means many who could benefit from finance are potentially losing out.

While commenting that the financial industry must be open to opportunities afforded by innovation, one panelist cautioned an eye must also be kept on the risks they may pose. Yet, all the panelists in this Davos session were enthusiastic about the growing influence and power artificial intelligence (AI) may have on the financial services industry.

Vince said AI is an exciting and transformative innovation for financial markets and its uses will be many across the industry – from internal business efficiencies to engendering greater access to personalized financial advice. Vince pointed to BNY Mellon’s own business, noting how teams are exploring how AI can be used to enhance its platforms, which in turn could help others run their businesses better.

BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material does not constitute a recommendation by BNY Mellon of any kind. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The views expressed within this material are those of the contributors and not necessarily those of BNY Mellon. BNY Mellon has not independently verified the information contained in this material and makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY Mellon assumes no direct or consequential liability for any errors in or reliance upon this material.

This material may not be reproduced or disseminated in any form without the express prior written permission of BNY Mellon. BNY Mellon will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice. Trademarks, service marks, logos and other intellectual property marks belong to their respective owners.

©2024 The Bank of New York Mellon. All rights reserved.