Banks must strike a careful balance between helping to fuel economic activity with loans and keeping their balance sheets on solid ground. Banks commonly engage in corporate loans, commercial and residential mortgages, as well as other forms of lending, such as auto loans, consumer loans and even equipment leasing. However, this lending must be supported by a bank’s ability to meet regulatory capital requirements, manage liquidity and achieve profitability.

Risk transfer mechanisms can help them achieve an appropriate balance. They allow banks to allocate capital more effectively by transferring some or all of the credit risk inherent in their loan portfolios to investors (hence they are generally referred to as Credit Risk Transfers). Transferring this risk frees up previously allocated capital and may distribute the risk more broadly across suitable market participants.

One way to achieve this is through traditional cash securitization transactions, such as the issuance of asset-backed or mortgage-backed securities (ABS or MBS, respectively). In such transactions there is usually a true-sale of the loans to a Special Purpose Vehicle (SPV), thereby removing the majority of exposure from a bank’s balance sheet and freeing up the associated capital, while also providing financing for new lending. Banks may also retain an income stream by continuing to service the sold loans.

Another method is through the “synthetic” transfer of credit risk whereby there is no sale of the underlying exposure, and instead all – or, more usually, part of – the credit risk associated with a loan portfolio is transferred to willing investors. This could be, for example, through the purchase of credit insurance or other such protection, or through the issuance of a Credit Linked Note (CLN). Here, the bank retains the loans on its books but can reduce the capital allocated to them in line with the reduced (i.e., unprotected) risk exposure the bank retains.

Investors mainly consist of large asset managers and specialized credit funds but also include multilateral development banks and supranationals, public development funds, pension funds and insurance companies.

Trends toward wider use and growth

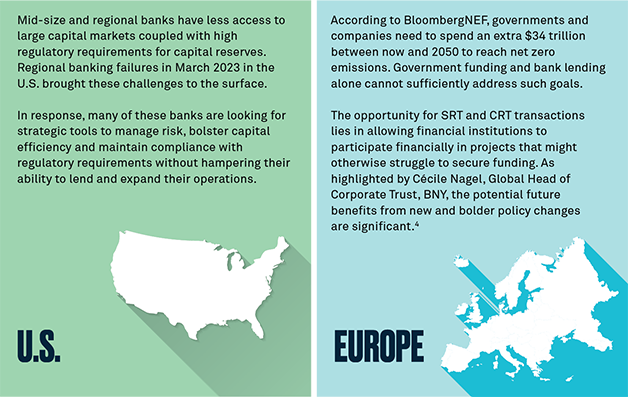

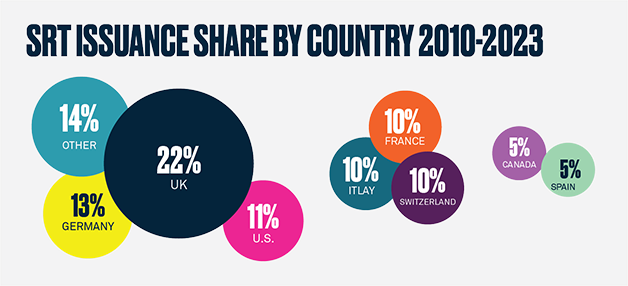

Understandably, regulators closely scrutinize banks’ risk transfer activities. In Europe, banks must seek approval from regulators to enter into such transactions and demonstrate that a “significant” portion of the risk associated with a particular exposure is being transferred – otherwise the transaction (or associated capital relief) will not be approved. These so-called “Significant Risk Transfer” or “SRT” transactions are crucial in Europe’s banking sector. They function as a tool to manage capital and efficiently enhance lending capabilities.1 As a result, volume has grown considerably following substantial regulatory clarifications published in 2017. Estimates suggest that Europe accounts for around 85% of the global SRT market.2

Figure 1: SRT issuance share by country 2010 - 2023

Data as published in "Banks face big decisions as money floods into synthetics," GlobalCapital Global ABS Special Report June 2024.

In BNY’s view, as a trustee supporting many SRT transactions, European SRTs could continue to expand, especially considering increasingly expensive capital alternatives and higher bank regulatory capital requirements due to Basel III.

In contrast, the United States Credit Risk Transfer (CRT) market is much smaller but potentially on the cusp of surging growth. It has drawn increased attention following several notable regional banking failures in March 2023. The Federal Reserve's clarification of capital rules has opened the door for banks to make better use of structures such as CLNs.3 In turn, these changes suggest a more upbeat outlook for adoption in the U.S. This positive momentum could help banks overcome balance sheet challenges and reinforce their capital positions.

Contrasting regulatory landscapes

While the European regulatory position since the 2008 Global Financial Crisis has restricted the resurgence of traditional securitization vs the U.S. market, European dominance in the synthetic risk transfer space stems from a clear and robust regulatory framework, including the EU's adoption of SRT in 2006 and the harmonized supervision by the Single Supervisory Mechanism (SSM) since 2014.5 In contrast, the U.S. regulatory approach to CRTs has been less prescriptive.

As such, Europe’s framework has provided banks a stable environment to manage their capital efficiency and risk profiles, including through SRT transactions. Greater regulatory certainty could allow for more flexible implementation of CRT transactions, providing options for banks to tailor these instruments to their specific needs and risk management strategies.

Impact of Basel III

Implementing Basel III has also helped fuel risk transfer transactions for European banks seeking to reduce risk-weighted assets. SRTs provide a cost-effective means of complying with enhanced capital requirements, contributing to the market's recent substantial growth.

Similarly, in the U.S., higher capital requirements from expected Basel III regulations have spurred banks of all sizes to seek efficient ways to manage their capital and risk exposure. There, securitization (ABS and MBS) and Credit Default Swaps (CDS) remain the most common methods. Compared to these, CRT transactions reduce risk-weighted assets (RWA) and improve capital ratios by transferring credit risk to investors.

"Away from traditional cash securitization, synthetic CRTs offer a viable alternative solution enabling banks to economically transfer the credit risk of their loan portfolios to investors. They are another tool helping banks maintain compliance with regulatory capital requirements while optimizing their balance sheets and lending capacity," explained Jerome Beadle, Managing Director, Global Head of Structured Finance Product Group, BNY.

Challenges facing risk transfer securitizations

While regulatory developments have been promising, two core challenges remain. The current "higher-for-longer" interest rate environment presents headwinds for the securitization market, particularly in terms of funding costs, market liquidity and credit risk modelling. Macroeconomic factors, such as inflation and geopolitical tensions, also play a crucial role.

Rate environment

Higher interest rates can increase the cost of borrowing for banks and also the cost of credit protection due to higher default risk. They may impact the pricing and attractiveness of such risk transfer strategies as investors seek higher yields/risk premiums. Similarly, higher rates can tighten market liquidity, adding to challenges as investors become more cautious.

Macroeconomic factors

Other broad market forces, such as inflation, might also erode real returns on investments, making certain instruments less attractive unless they offer higher yields to compensate. Geopolitical tensions can accentuate market volatility and risk aversion, making it harder for banks to manage their portfolios effectively. The European Systemic Risk Board highlights that these factors can significantly impact funding needs, especially in the European Union.6

The role of trustees and agents

As with traditional cash securitizations, trustees or agents can support a risk transfer deal in several ways. Where relevant, these ancillary services can include holding collateral, monitoring and reporting, provision of paying agency services, and traditional trustee services.

Oversight by an independent trustee or agent can help enhance stability and trust in these instruments. It also helps manage risk and promote transparency. As such, providers need to stay abreast of regulatory changes and other developments to adapt and support the evolution of this market.

Setting the stage for transformation and sustainability

As the risk transfer market evolves, innovative approaches should gain traction, reshaping the landscape for banks and investors.

First, there is a growing emphasis on digital transformation. Technological advances are improving the efficiency, transparency and security of these transactions, and securitization transactions more generally, with improved data management and reporting. Such efforts can enable more precise risk assessments, streamline processes, and give investors real-time access to critical information. This push for transparency and efficiency is driven by the need to build trust and stability in the market, leading to increased liquidity and more competitive pricing.

Second, many stakeholders expect the wider securitization market to help support sustainability and broader societal goals. For example, green transactions use proceeds from securitizations to fund environmentally sustainable projects, support the transition to a low-carbon economy and align with global efforts to combat climate change. Their emergence reflects a growing awareness of the role that financial instruments can play in promoting sustainability and responsible investment. By freeing up capital for environmentally-focused projects, banks can contribute to innovative solutions while managing their own risk profiles and capital requirements.

The path to future success

Expanding CRT (including SRT) markets can help support banks’ ability to manage capital more efficiently. It can also have more profound implications for the global financial ecosystem by stimulating the flow of private capital, ultimately fostering economic growth and stability. However, to fully realize the potential of these markets, stakeholders must work together to address the challenges and seize the opportunities that lie ahead.

Specifically, banks and investors must continue to embrace digital transformation, build new capabilities and forge strategic partnerships to navigate the complexities of these transactions effectively.

Additionally, regulators and policymakers should continue to support the development of a robust and transparent framework that promotes stability and innovation. By smoothing the path to securitization risk transfer, we can help increase opportunities to fund global priorities while continuing to satisfy appetites for high-quality investible assets.

1 “The European significant risk transfer securitisation market,” ESRB Occasional Paper Series, no. 23, 2 October 2023.

2 “SRT Chronicles”, Structured Credit Investor, Olivier Renault, 2021, as cited in ESRB Occasional Paper Series, no. 23.

3 See “Frequently Asked Questions about Regulation Q,” Board of Governors of the Federal Reserve System, September 28, 2023 and “Federal Reserve’s Capital Relief Change Eases Path to Basel III,” Cris Cicala, Bloomberg Law, February 20, 2024.

4 “Facing Europe’s Financing Gap,” Cécile Nagel, EUROFI, February 21, 2024.

5 “Guidelines on Significant Credit Risk Transfer relating to Articles 243 and Article 244 of Regulation 575/2013,” European Banking Authority, July 7, 2014.

6 “The European significant risk transfer securitisation market,” ESRB Occasional Paper Series, no. 23, 2 October 2023.

Disclaimer

BNY, BNY Mellon and Bank of New York Mellon are corporate brands of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material does not constitute a recommendation by BNY of any kind. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The views expressed within this material are those of the contributors and not necessarily those of BNY. BNY has not independently verified the information contained in this material and makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY assumes no direct or consequential liability for any errors in or reliance upon this material.

This material may not be reproduced or disseminated in any form without the express prior written permission of BNY. BNY will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice. Trademarks, service marks, logos and other intellectual property marks belong to their respective owners.

©2024 The Bank of New York Mellon. All rights reserved. Member FDIC.