Global issuers are seeking new sources of lower-cost financing in response to today’s macro backdrop. This follows an increasingly divergent growth path in major economies, where differing monetary policies have created a capital-raising landscape underpinned by a higher-for-longer interest rates regime.

In turn, global issuers are casting a wide net to explore markets with favorable conditions and lower costs, either for trade financing or foreign exchange swaps to their operating base currency to fund subsidiaries and operations.

The Dim Sum bond market – comprised of offshore, renminbi (“RMB”) denominated bonds issued outside Mainland China, could be an efficient capital market for issuers to consider.

Looking East: Growth of Dim Sum bonds

Dim Sum bonds have become an increasingly attractive capital raising channel. The more favorable interest rate of RMB, following sharp global monetary tightening, provides global issuers with the option of raising capital in offshore RMB, at a lower cost, to finance trade in China or swap into U.S. Dollars and other currencies.

According to the Hong Kong Monetary Authority (the “HKMA”), Dim Sum bonds issued in Hong Kong in the first half of 2024 saw an impressive year on year increase of 93% from USD 28.2 billion (RMB 205 billion) to USD 54.5 billion (RMB 396 billion), while the total outstanding value of RMB debt securities was USD 120.5 billion (RMB 876.5 billion).

The first half of 2024 has seen several notable deals from international issuers such as Goldman Sachs Finance Corp, JP Morgan Chase Bank, Prologis, LP, Barclays Bank PLC, UK, Industrial and Commercial Bank of China. Where the bonds paid a coupon, the coupons ranged from 2% to 3.6% for 1 to 5-year tenure.

There are several drivers behind this growth. A key contributor has been the relative cost advantage in the prevailing global interest rate environment. “The U.S. Federal Reserve delivered a 525bp policy tightening between March 2022 to July 2023. The interest rate differential has led to a stronger U.S. Dollar against global currencies. The elevated U.S. Federal Funds Rate is likely to be for longer given the resiliency of the US economy,” said Chong Wee Khoon, APAC Macro Strategist at BNY.

At the same time, China is currently experiencing deflation across its economy. “Even though producer prices are recovering, the pressure from the property sector and growing surplus capacity in manufacturing are likely to limit China’s ability to raise prices in the near term. This will require the People's Bank of China (PBoC) to maintain an accommodative monetary policy stance for a prolonged period and may warrant additional rate cuts,” added Aninda Mitra, Head of Asia Macro and Investment Strategy at BNY Investments.

Aside from rate differentials, the development of bond market infrastructure and relaxation of cross- border bond investment inflows have also supported the demand for Dim Sum bonds. The Central Securities Depository (CSD) in Hong Kong — the Central Moneymarkets Unit (CMU) — has used its linkages with regional and international financial market infrastructure to establish international issuance and settlement procedures that most international issuers are familiar with. In addition, CMU is the only offshore CSD in the world that offers mutual bond market access between Hong Kong and China via a scheme called Bond Connect.

This cross-border link between CMU and Mainland central securities depository delivers crucial underlying infrastructure to enable this mutual access. In support of improving cross-border settlement, CMU maintains a close dialogue with Mainland authorities and policy units, and partners with various market infrastructures to expand service offerings of offshore RMB products.

One example of CMU's involvement was its participation in the Mainland’s Cross-Border Interbank Payment System ("CIPS") which enables efficient clearing and settlement of cross-border RMB payments. CMU is also actively advocating with Mainland policy makers to mobilize the Bond Connect holding as collateral to create opportunities for offshore and cross-border repo transactions. These efforts aim to improve RMB offshore liquidity arrangements and optimise the use of bonds held by international investors.

Bond Connect: Access to investors and liquidity

Bond Connect was launched to promote the development of the bond markets in Hong Kong and the Mainland. Of the two sub-schemes - Northbound Bond Connect and Southbound Bond Connect - the latter, launched in 2021, enables eligible Mainland institutional investors to invest in the Hong Kong Dim Sum bond market.

Thanks to seemingly growing interest from Mainland investors who want to benefit from higher offshore rates and to diversify their investment portfolio by accessing a wider range of offshore RMB, issuers can benefit from a steady source of liquidity to draw upon.

To capitalize on this, several policy initiatives introduced in recent years have strengthened the offshore RMB market infrastructure to make it attractive to investors. Notably, Mainland and Hong Kong governments regularly issue bonds to support liquidity and pricing benchmarks. Further, the PBoC has also encouraged more investor participation through setting up bilateral currency swap arrangements with regional central banks, as well as expanding the eligible collateral accepted in the offshore RMB Liquidity Facility and improving lending terms.

U.S. issuers: Navigating a new market

Despite the potential the Dim Sum bond market offers, U.S. issuers have historically faced complexities in servicing the income payments of a bond through its lifecycle.

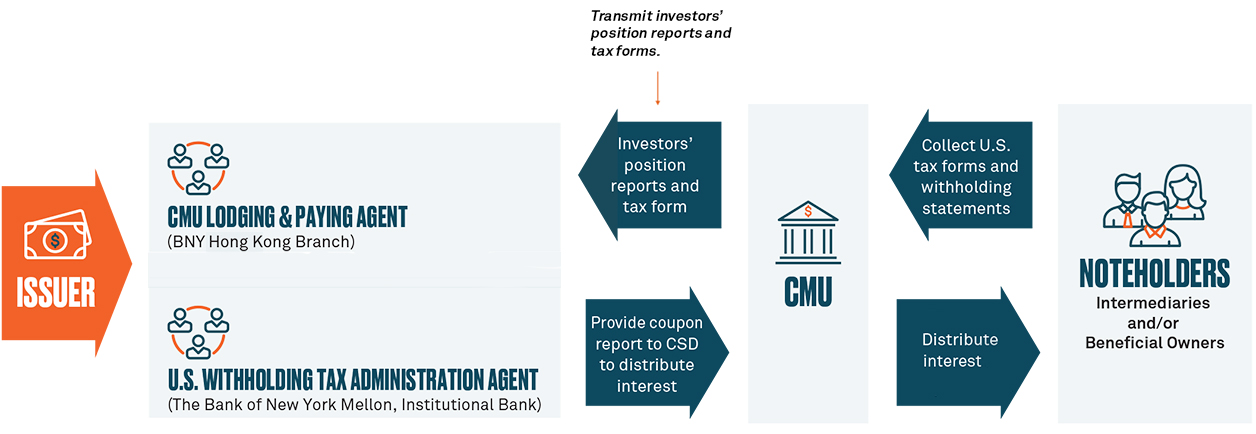

In particular, there is the challenge in making income distributions, given these are subject to U.S. withholding tax requirements. Under the U.S. tax code, domestic entities making U.S.-source interest payments to foreign entities are subject to withholding tax requirements where they must report and withhold 30% of the gross U.S.-source payments.

The process entails collecting U.S. tax forms and withholding statements from bondholders and certifying their eligibility for an exemption or a lower rate. The issuer must determine the amount to withhold on the gross interest amount and thereafter file an information return. They must then contact bondholders to coordinate their submission of tax forms. Further, they need to orchestrate withholding and interest payments to the paying agent to facilitate payments to bondholders.

Tackling the tax challenge

While some issuers may consider these requirements onerous, a specialized solution is now available. Developed in collaboration with the CMU, BNY’s U.S. withholding tax service simplifies U.S. issuers’ ability to access the Dim Sum bond market by helping them more easily adhere to U.S. tax withholding requirements on U.S.-source income paid to foreign persons and entities.

As a result of serving as both U.S. withholding tax administration agent and CMU lodging and paying agent, issuers benefit from a single, integrated solution to optimize efficiency and help mitigate risk.

Delivering meaningful solutions and market access

The complex challenges in making a debut issuance in a new market is a balancing act where issuers’ success can hinge on collaborating with the right agent to navigate the issuance and payment processes. “At BNY, we provide connectivity into global markets – coupled with deep expertise – to facilitate clients’ broad range of strategic funding needs,” said Adelene Ang, Director, Head of Product, Corporate Trust, APAC.

In addition to helping issuers access cost effective funding sources and serving as trustee through the life of the transaction, many derive value from tapping into a broader suite of BNY solutions across the financial lifecycle. These often include treasury services, FX offerings and liquidity management solutions, where excess cash balances can be swept into a money market fund to help enhance yield.

Ultimately, a smooth, efficient and more user-friendly process for issuers to raise new debt, refinance and securitize in global markets is anticipated to be in high demand for the foreseeable future. Sitting at the heart of the financial system, BNY delivers the knowledge, scale, resilience and innovation essential to helping issuers succeed.