Facing Europe’s financing gap

The time is now for a new era of securitization.

Cecile Nagel

Time to Read: 5 minutes

A version of this article first appeared in VIEWS the EUROFI Magazine on February 21, 2024. It is republished here with permission.

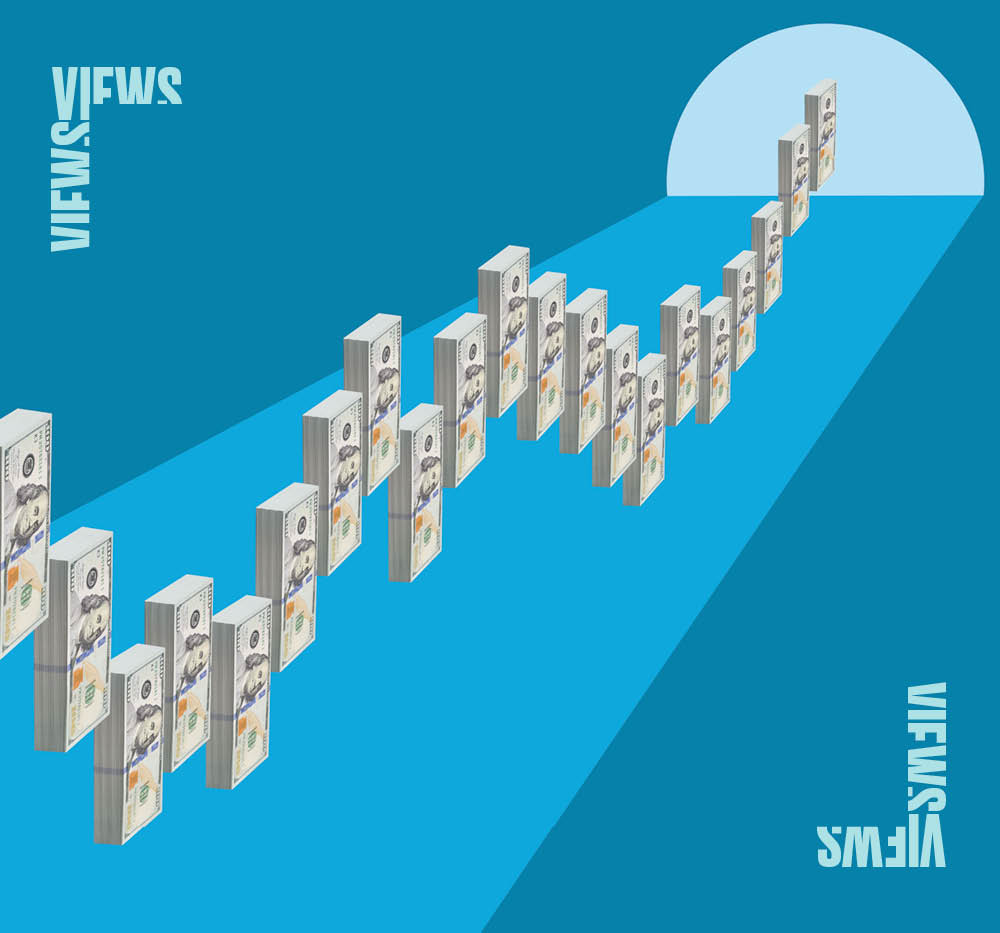

International Monetary Fund data show under one-third of economic financing in Europe derives from Capital Markets compared to banks, versus over two-thirds in the United States.1 In its Securitization Data Snapshot for 2022, the Association for Financial Markets in Europe (AFME) identified that total European securitization issuance was less than 10% of the size of U.S. securitization issuance, compared to 85% in 2008.2

Regulatory action and investor appetite in the United States have helped securitization flourish and provided financing beyond traditional consumer-facing asset classes to receivables arising from, among others, data centers, fiber optics, mobile phones and infrastructure, solar and wind farms.

A new European legislative cycle provides an opportunity to close this gap. As such, now is a critical moment to make securitization a reliable mechanism for capital diversification. Doing so could deliver benefits such as investment diversification, credit risk distribution, market resilience and balance sheet efficiency.

Policy makers and market participants learned many lessons from the events of 2008. More discipline around underlying assets and structures and more robust risk controls have already come into play. There is also a deeper understanding of the operationally stabilizing effects provided throughout the investment lifecycle via the role of trustees, agents and other similar institutional providers.

Further strengthening securitizations' post-crisis credibility — and realizing its benefits — requires action from public entities and private market participants to achieve greater clarity and stability without limiting innovation.

Simple, transparent and standardized (STS) criteria are one such mechanism. STS disclosure rules have already improved investor perceptions and will continue to spur confidence among investors. However, issuing parties must carefully manage their minimum risk retention requirements. Documentation and data quality also need to be addressed to avoid undue operational stress on issuers and their service providers.

Another relative European success story in recent years, helped by regulation including STS, has been the increasing use of significant risk transfer (SRT) mechanisms by banks. As more banks and investors explore this approach, policymakers may wish to consider ways to streamline the current supervisory assessment process to manage increasing volumes, albeit without diluting standards.

Forward momentum for securitization hinges on further work from public authorities and private stakeholders.

The potential future benefits from new and bolder policy changes are significant. Rebuilding market confidence is essential for making securitization a larger element in Europe’s capital markets. Important public policy steps have already been taken. The role of trustees and agents in providing confidence and operational stability for investors should also be recognized and supported. A larger role for securitization can help drive sustainable growth and stability across the bloc.

BNY, one of the world’s largest alternative asset servicing firms, was named as the winner of the ‘Custodian Service of the Year’ Category at the 2024 Private Equity Wire European Credit Awards. Elliott Brown, Global Head of Alternatives for Fund Services, outlines some of the challenges and opportunities in the private credit space.

Virtual accounts have emerged as a strategic solution for corporate treasurers to address complexities associated with traditional bank account structures and seeking smarter ways to manage liquidity, improve working capital and increase operational efficiencies.

The Dim Sum bond market – comprised of offshore, renminbi denominated bonds issued outside Mainland China, have become an increasingly attractive capital raising channel.

In a payments landscape where change is the only constant, the role of corporate treasurers is shifting away from traditional operational and manual duties and moving towards that of strategic technologists.