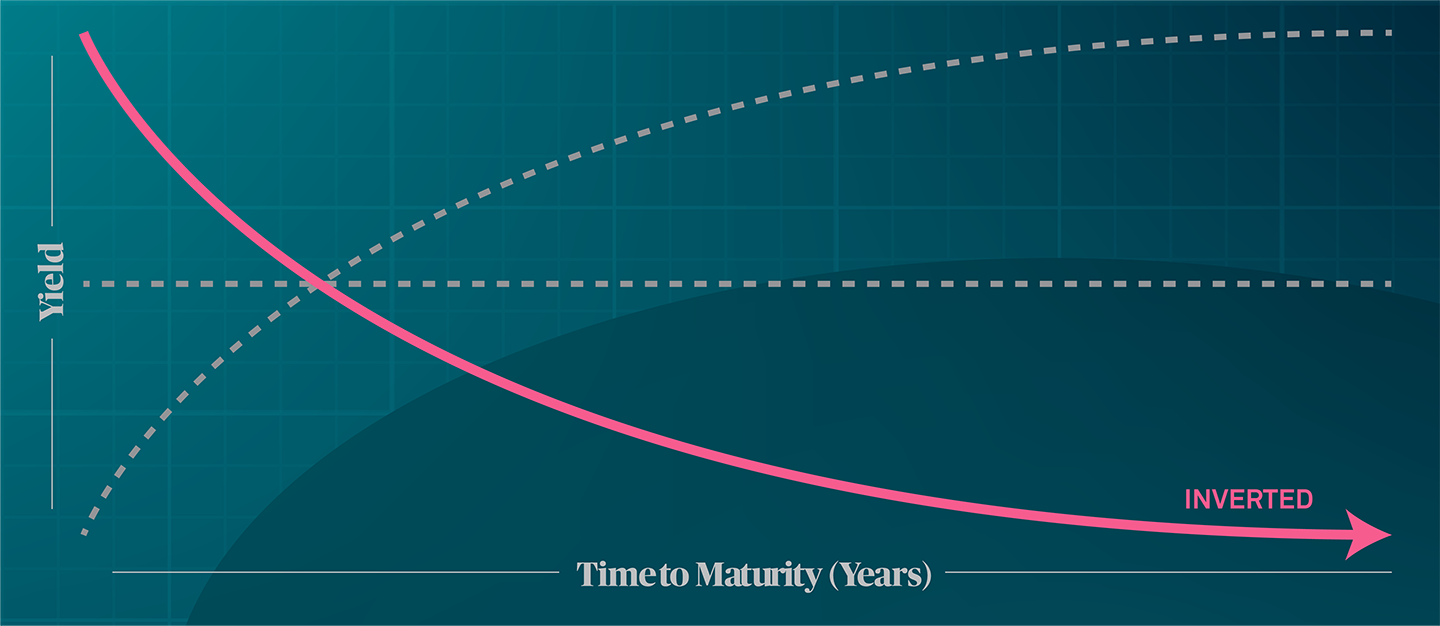

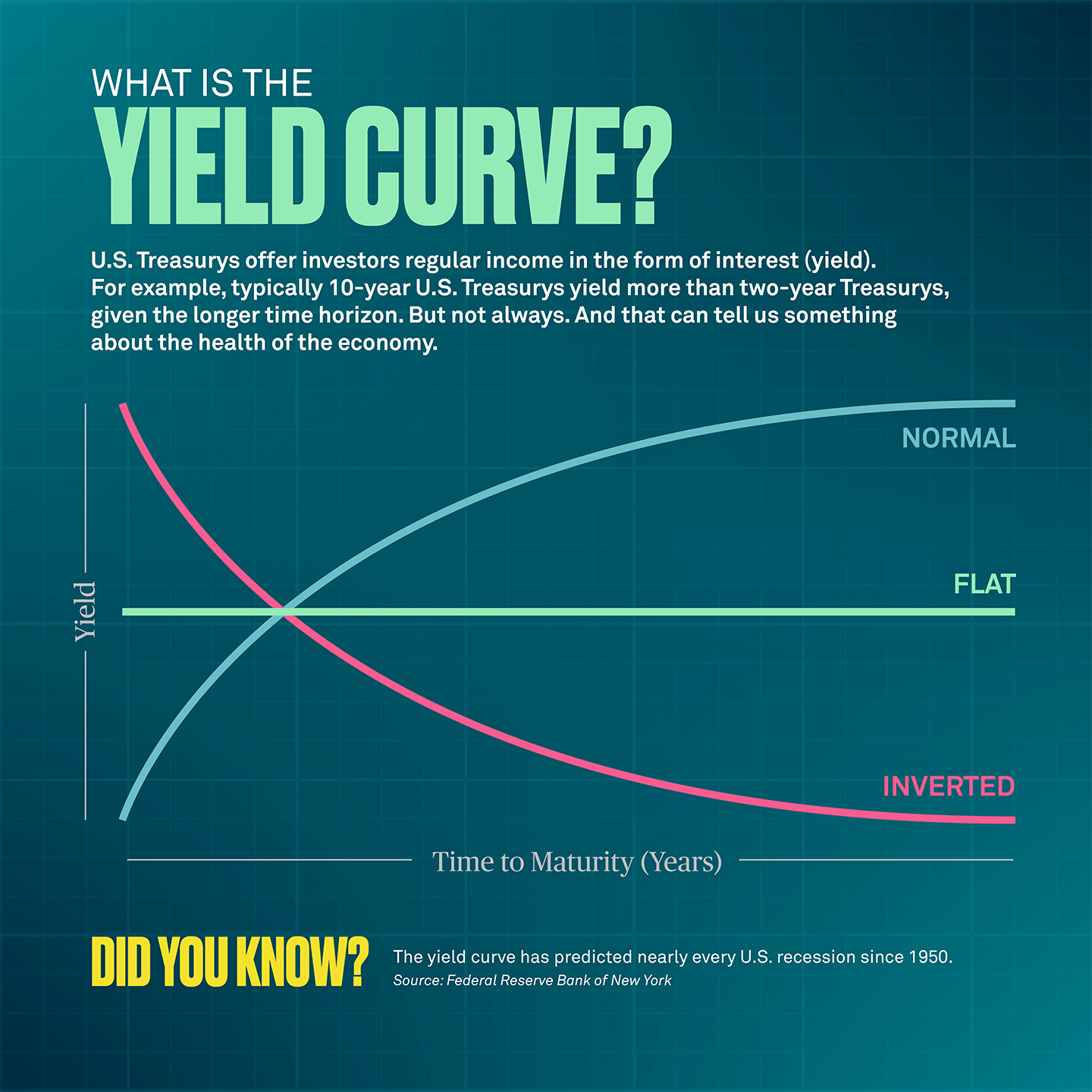

The yield curve (2s10s) may still be inverted, indicating the yield on two-year Treasurys is currently higher than 10-year Treasuries, but a steepening may soon change that. The inverted position of the curve – which typically precedes a recession – looks to be moving after an unusually long period (since July 2022).

How did we get here?

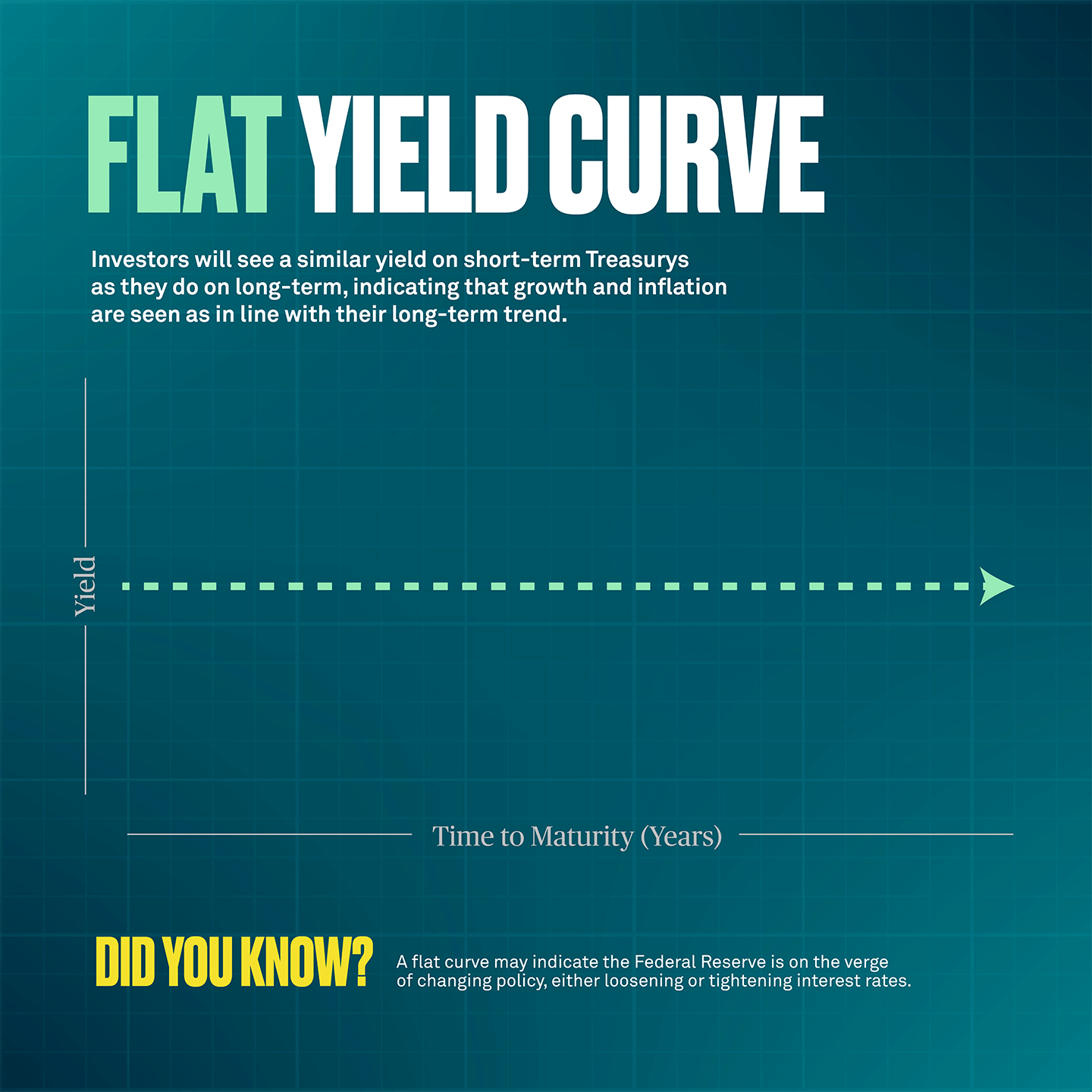

The Federal Reserve shifted their monetary policy and hiked interest rates aggressively to control inflation (2022/2023). Borrowing costs increased particularly in the short end of the curve as investors priced in a period of elevated inflation and restrictive policy, but with expectations for a normalization in both for the years ahead.

What is this saying?

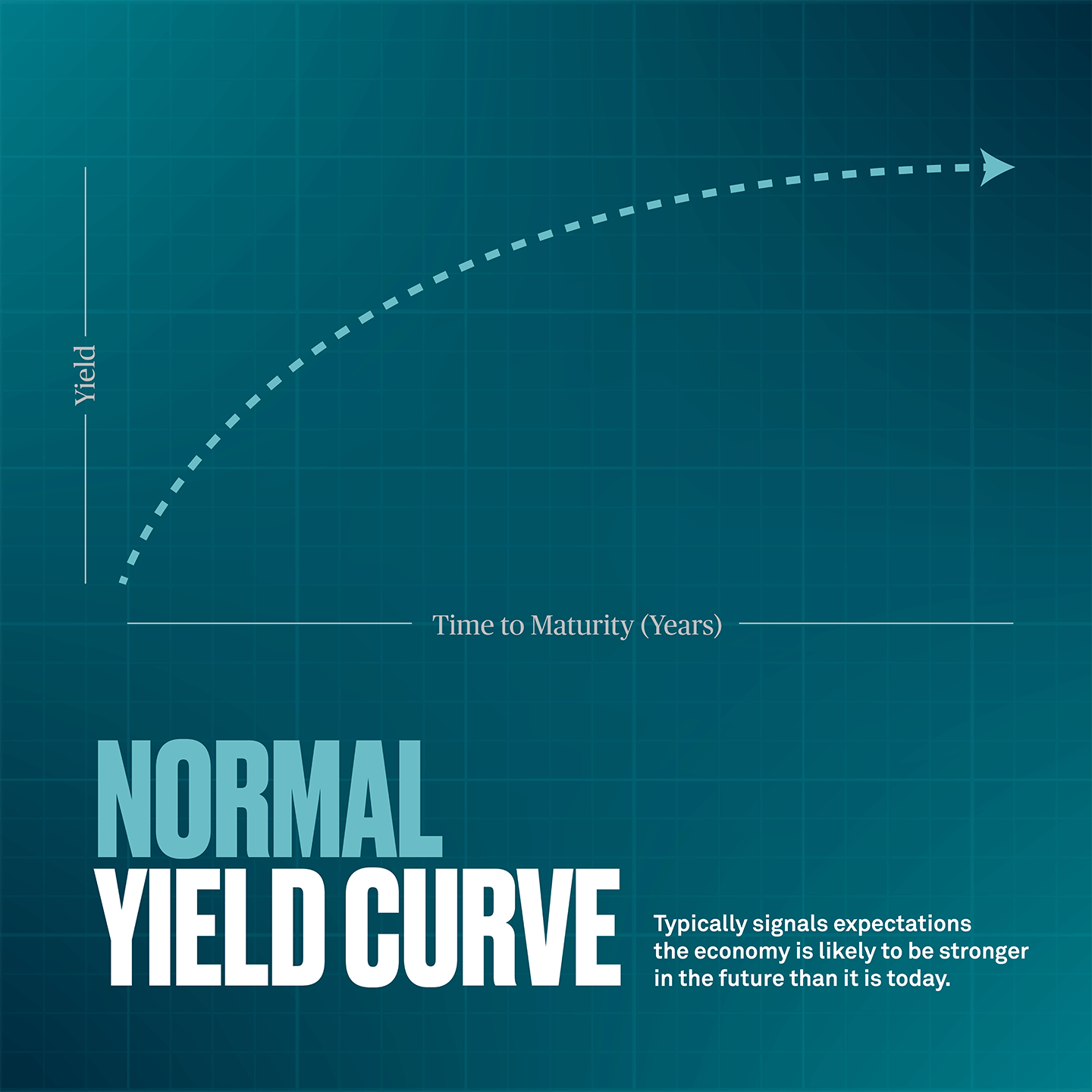

A steepening of the yield curve usually hints at an impending economic slowdown or recession. But this time has been somewhat different. Investors appear to be pricing in a stronger long-term rate of growth for the U.S. economy (a so-called bear steepening).

While a further steepening of the yield curve is the most likely scenario, the underlying reason matters a great deal for investors. A bear steepening tends to favor riskier assets, like equities.

Where are we going?

In recent months, the U.S. yield curve has started to steepen (becoming less negative) from previously very inverted levels.

This is being driven by long-term Treasury yields moving higher and short-term interest rates falling a little. While the yield curve may remain somewhat volatile over the coming months, a further steepening is the most likely path from here.