A series of macroeconomic trends are driving market consolidation in the transaction banking space. BNY’s Bana Akkad-Azhari, Head of Treasury Services EMEA, examines the evolving ecosystem and the benefits of collaborating with a single provider.

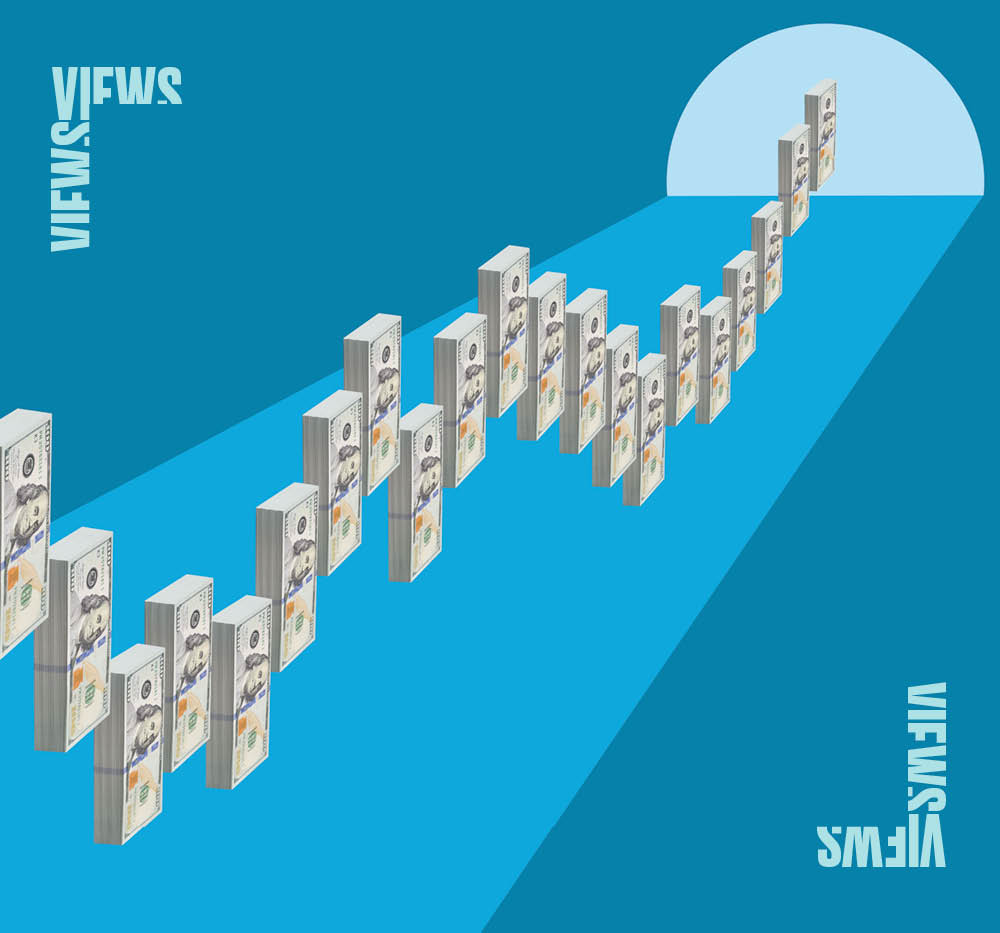

Players in the transaction banking space have been hit by a perfect storm in recent years. Rapid technological changes, shifts in client expectations and successive milestone events for the industry – including the ongoing ISO 20022 migration and upcoming move to a T+1 settlement cycle in the U.S. – have compelled banks to re-evaluate how they interact with customers. This comes at a time when financial markets continue to face a period of uncertainty, driven by the high inflationary environment, as well as the ongoing geopolitical unrest in Europe and the Middle East.

In response to these challenges, financial institutions have been working not only to mitigate emerging risks and meet industry mandates, but also to keep pace with digital innovation, adopt automated workflows, support clients’ sustainability objectives, and collaborate with fintechs – all while contending with increasing costs in compliance and services.

Charting a course...

To stay ahead in this evolving environment, transaction banking clients are looking for correspondent banking partners that can meet their rapidly changing technology needs, as well as their liquidity requirements. For smaller providers, the associated costs means that this is not always possible – and many players have looked to withdraw from certain jurisdictions.

With the correspondent banking network under pressure, there is a renewed focus on larger transaction banks and the role they can play in providing these critical services on a global scale. This is driving a trend toward market consolidation, as players look to rationalize and shore up their correspondent banking relationships.

...with a reliable navigator

Already operating in most major markets, global transaction banks – with their resilient long-standing quasi-infrastructure position in the global financial ecosystem – are well placed to support players in this newly consolidating environment, especially when it comes to large market movements like the ISO 20022 transition or the T+1 migration.

Major transaction banks also offer opportunities for scale and growth due to their ability to navigate different legal and regulatory regimes, as well as their position as reliable and safe entry points into major markets. It means that if an institution were looking to enter or expand their North American operations, employing a global transaction bank would greatly simplify the process. When it comes to FX needs, for example, working with a provider that has a fullsuite of FX multicurrency services ensures access to a host of ready-made solutions and services.

The transaction banking market position also necessitates more careful risk management – which market players need now more than ever in the current turbulent environment. While once considered a slow and lumbering industry, correspondent banking has evolved with the times – still resilient and systemic, but equally innovative in their offering. This amply demonstrated with the exploration and implementation of new technologies including AI, APIs and blockchain. Careful management of and significant investment in these innovations has also hedged custodian banks against the inherent risks associated with shorter settlement cycles, especially cybercrime and fraud. As a result, transaction banking players are well served by a reliable and trustworthy correspondent banking partner in this changing environment.

BNY, BNY Mellon and Bank of New York Mellon are corporate brands of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally and may include The Bank of New York Mellon, a banking corporation organized and existing pursuant to the laws of the State of New York operating in the United States at 240 Greenwich Street, New York, NY 10286 and operating in England through its branch at 160 Queen Victoria Street, London EC4V 4LA, England. The information contained in this material is for use by wholesale clients only and is not to be relied upon by retail clients. Not all products and services are offered at all locations.

This material, which may be considered advertising, is for general information and reference purposes only and is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. This material does not constitute a recommendation by BNY of any kind. The views expressed within this material are those of the contributors and not necessarily those of BNY. BNY has not independently verified the information contained in this material and makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY assumes no direct or consequential liability for any errors in or reliance upon this material.

This material may not be reproduced or disseminated in any form without the express prior written permission of BNY. BNY will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice. Trademarks, service marks, logos and other intellectual property marks belong to their respective owners.

©2024 The Bank of New York Mellon. All rights reserved. Member FDIC.