THE STATE OF THE U.S. RETAIL INVESTOR: INSIGHTS & IMPLICATIONS

2022 BNY Mellon Retail Investor Survey

Time to Read: 18 minutes

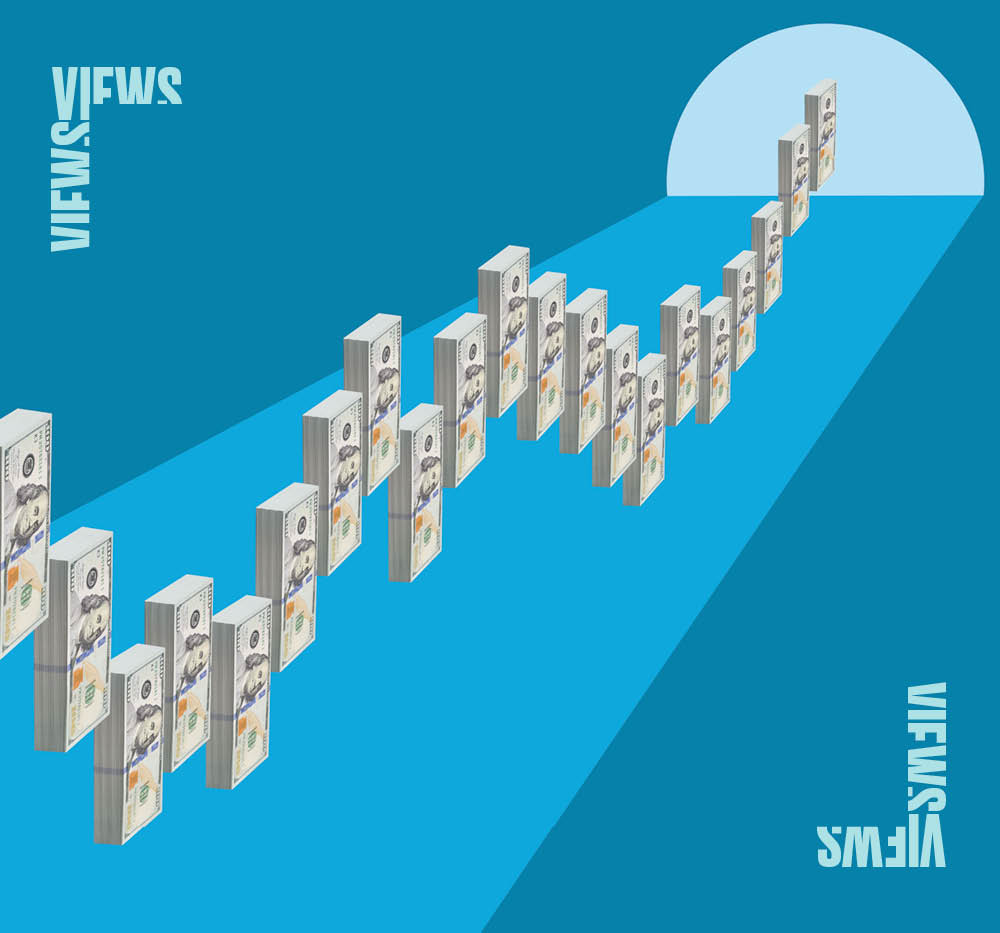

Over the past several years the heightened market activity and engagement of U.S. retail investors has been intriguing to watch. A number of factors continue to have a profound influence on the retail investor segment including technology advancements in trading as well as the impact of inflation.

It is well-known that market conditions of recent years from COVID-19 to rising costs and constraints on supply chains and staffing have triggered volatility in individual equities along with fluctuations in the overall market as stock prices reflected corporate performance. But what is most interesting is how retail investors responded to these circumstances.

In an initial assessment of these trends, the BNY Mellon Retail Investor Survey tracked the effect on investing behavior across four retail investor cohorts; nascent investors, traditional Investors, established investors and retirement investors. The majority of respondents in all four cohorts view individual stocks as the asset class that will provide the greatest short and long-term rates of return.

The survey not only provides trends and insights into the asset classes, investment horizons, sectors and sources of information for these cohorts, but also provides both issuers and asset managers tactics to market, communicate and educate these cohorts.

BNY, one of the world’s largest alternative asset servicing firms, was named as the winner of the ‘Custodian Service of the Year’ Category at the 2024 Private Equity Wire European Credit Awards. Elliott Brown, Global Head of Alternatives for Fund Services, outlines some of the challenges and opportunities in the private credit space.

Virtual accounts have emerged as a strategic solution for corporate treasurers to address complexities associated with traditional bank account structures and seeking smarter ways to manage liquidity, improve working capital and increase operational efficiencies.

The Dim Sum bond market – comprised of offshore, renminbi denominated bonds issued outside Mainland China, have become an increasingly attractive capital raising channel.

In a payments landscape where change is the only constant, the role of corporate treasurers is shifting away from traditional operational and manual duties and moving towards that of strategic technologists.