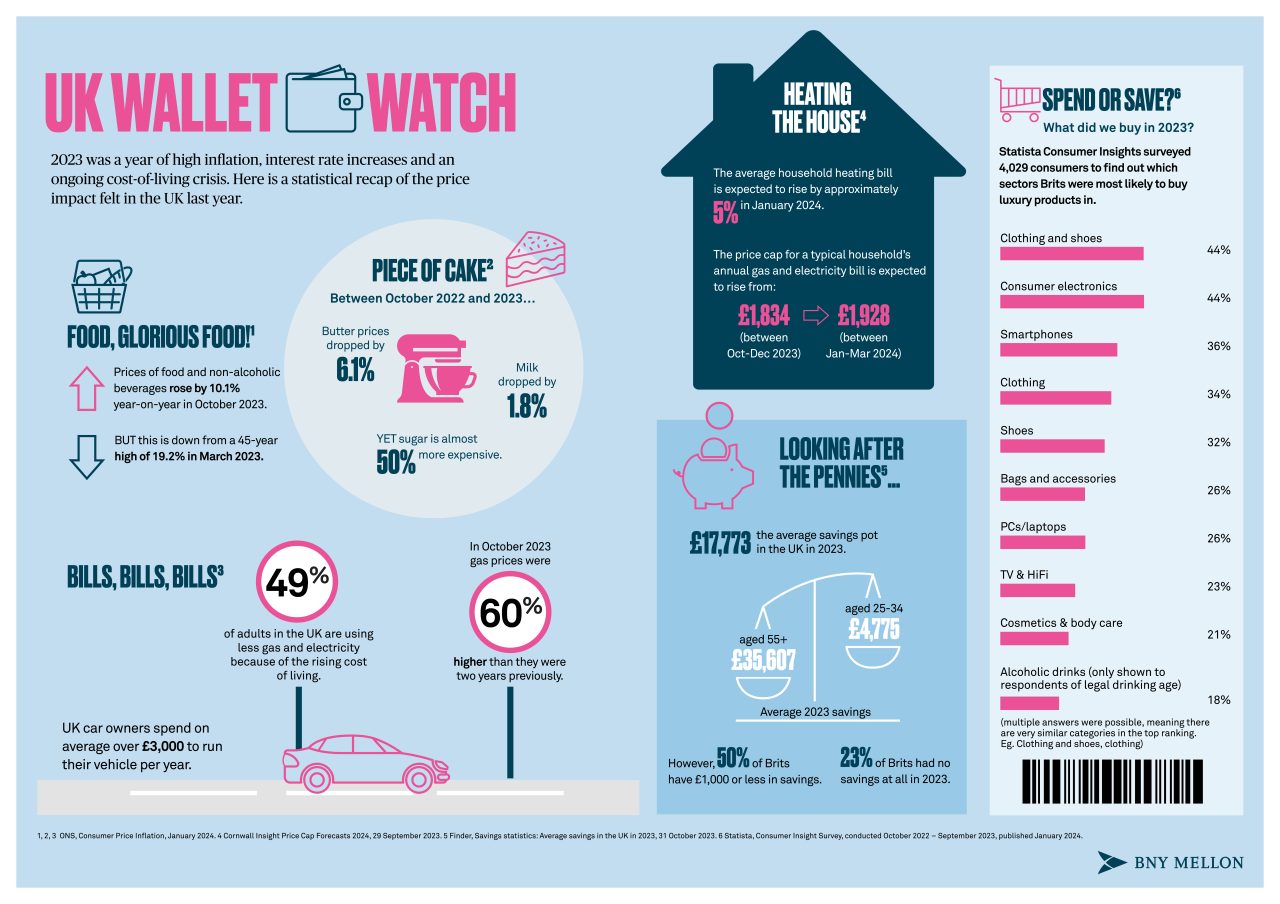

2023 was a year of high inflation, interest rate increases and an ongoing cost-of-living crisis. Discover more with BNY Mellon Investment Management's wallet watch.

UK wallet watch

BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material does not constitute a recommendation by BNY Mellon of any kind. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The views expressed within this material are those of the contributors and not necessarily those of BNY Mellon. BNY Mellon has not independently verified the information contained in this material and makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY Mellon assumes no direct or consequential liability for any errors in or reliance upon this material.

This material may not be reproduced or disseminated in any form without the express prior written permission of BNY Mellon. BNY Mellon will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice. Trademarks, service marks, logos and other intellectual property marks belong to their respective owners.

©2024 The Bank of New York Mellon. All rights reserved.