We Help Clients Unlock Value from Their Securities Holdings

We clear and settle equity and fixed-income transactions in over 90 markets and handle most of the transactions cleared through the Federal Reserve Bank of New York for all 24 primary dealers.*

We are focused on helping our clients around the world take advantage of the unique perspective that comes from clearing and settling equity and fixed-income transactions in markets around the globe. We manage over $5.2 trillion in collateral worldwide for our clients.

Our clients look to us for our global reach, expertise and operational excellence as we deliver our services, including securities clearance, to financial institutions and corporations worldwide.

Capabilities

Manage Your Collateral Schedules

RULE, our new online collateral schedule platform. This easy-to-use tool can help you manage all the key aspects of your collateral relationships. RULE creates a flexible, collaborative and intelligent environment for the management of your collateral schedules. So enhance the efficiency of your workflow and take full control of your collateral schedules with our new platform, designed to better integrate your needs—and our services.

Benefits of Digital Transformation

As a result of our investment in this technology, you’ll be able to streamline your end-to-end collateral schedule workflow. That doesn’t just mean improved operational efficiency; it may also reduce your time-to-market as well as enhance your risk profile.

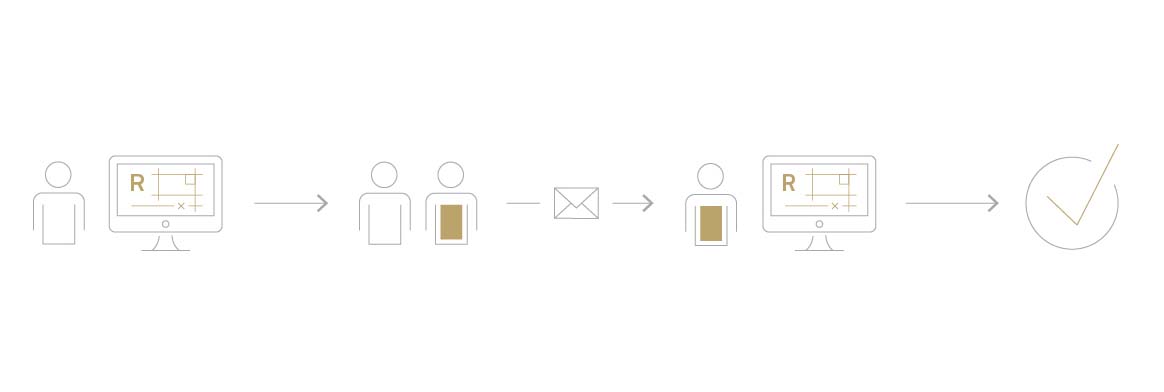

How It Works: 1) Set up your criteria; 2) Negotiate your schedules; 3) Counterparty confirms; 4) Approved

Through RULE you’ll be able to:

- Define your collateral eligibility criteria.

- Negotiate schedules with your counterparties and receive feedback in real time.

- Legally agree to your collateral schedules electronically.

- Efficiently manage your risk.

Our Insights

Banks must strike a careful balance between helping to fuel economic activity with loans and keeping their balance sheets on solid ground.

Mutual funds, exchange-traded funds (ETFs), and separately managed accounts (SMAs) all saw net sales grow in Q1 2024.

As investors, leaders and specialists - women are increasing their presence across financial services. BNY looks at the growth of women in finance and why inclusivity is needed.

BNY Mellon Growth Dynamics data shows flow trends to U.S. equity ETFs in the second half of 2023 began to shift, leading to the highest U.S. equity flows in Q4 2023 since the end of 2021.

*Federal Reserve Bank of New York, Primary Dealers List

This material and any products and services may be issued or provided in various countries by duly authorized and regulated subsidiaries, affiliates, and joint ventures of BNY, which may include any of the following: The Bank of New York Mellon, at 240 Greenwich Street, NY, NY USA, 10286, a banking corporation organized pursuant to the laws of the State of New York, and operating in England through its branch at One Canada Square, London E14 5AL, UK, registered in England and Wales with numbers FC005522 and BR000818. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the US Federal Reserve and authorized by the Prudential Regulation Authority. The Bank of New York Mellon, London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon SA/NV, a Belgian public limited liability company, with company number 0806.743.159, whose registered office is at 46 Rue Montoyerstraat, B-1000 Brussels, Belgium, authorized and regulated as a significant credit institution by the European Central Bank (ECB), under the prudential supervision of the National Bank of Belgium (NBB) and under the supervision of the Belgian Financial Services and Markets Authority (FSMA) for conduct of business rules, and a subsidiary of The Bank of New York Mellon. The Bank of New York Mellon SA/NV operates in England through its branch at 160 Queen Victoria Street, London EC4V 4LA, UK, registered in England and Wales with numbers FC029379 and BR014361. The Bank of New York Mellon SA/NV (London Branch) is authorized by the ECB and subject to limited regulation by the Financial Conduct Authority and the Prudential.

Regulation Authority. Details about the extent of our regulation by the Financial Conduct Authority and Prudential Regulation Authority are available from us on request The Bank of New York Mellon SA/NV operating in Ireland through its branch at 4th Floor Hanover Building, Windmill Lane, Dublin 2, Ireland trading as The Bank of New York Mellon SA/NV, Dublin Branch, is authorized by the ECB and is registered with the Companies Registration Office in Ireland No. 907126 & with VAT No. IE 9578054E. The Bank of New York Mellon, Singapore Branch, subject to regulation by the Monetary Authority of Singapore. The Bank of New York Mellon, Hong Kong Branch, subject to regulation by the Hong Kong Monetary Authority and the Securities & Futures Commission of Hong Kong. If this material is distributed in Japan, it is distributed by The Bank of New York Mellon Securities Company Japan Ltd, as intermediary for The Bank of New York Mellon. If this material is distributed in, or from, the Dubai International Financial Centre (“DIFC”), it is communicated by The Bank of New York Mellon, DIFC Branch, regulated by the DFSA and located at DIFC, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE, on behalf of The Bank of New York Mellon, which is a wholly owned subsidiary of The Bank of New York Mellon Corporation. This material is intended for Professional Clients only and no other person should act upon it. Not all products and services are offered in all countries. Please contact your BNY representative to identify the relevant BNY entity associated with the services in question.

The information contained in this material is intended for use by professional clients or the equivalent only and is not intended for use by retail clients. If distributed in the UK, this material is a financial promotion.

This material, which may be considered advertising, is for general information purposes only and is not intended to provide legal, tax, accounting, investment, financial or other professional advice on any matter. This material does not constitute a recommendation by BNY of any kind. Use of our products and services is subject to various regulations and regulatory oversight. You should discuss this material with appropriate advisors in the context of your circumstances before acting in any manner on this material or agreeing to use any of the referenced products or services and make your own independent assessment (based on such advice) as to whether the referenced products or services are appropriate or suitable for you. This material may not be comprehensive or up to date and there is no undertaking as to the accuracy, timeliness, completeness or fitness for a particular purpose of information given. BNY will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice. Information contained in this material obtained from third-party sources has not been independently verified by BNY, which does not guarantee the completeness or accuracy of such information. BNY assumes no direct or consequential liability for any errors in or reliance upon this material. The statements and opinions expressed by the panelists are those of the panelists as of February 20, 2018 and do not necessarily represent the views of BNY.

This material may not be distributed or used for the purpose of providing any referenced products or services or making any offers or solicitations in any jurisdiction or in any circumstances in which such products, services, offers or solicitations are unlawful or not authorized, or where there would be, by virtue of such distribution, new or additional registration requirements.

All references to dollars are in US dollars unless specified otherwise.

This material may not be reproduced or disseminated in any form without the prior written permission of BNY.

Trademarks, logos and other intellectual property marks belong to their respective owners. The Bank of New York Mellon is a member of the Federal Deposit Insurance Corporation (FDIC).